FreedUp

Freed Up is a six week course designed with practical tools and biblical teaching to help you pursue financial health today and as you build toward the future!

The Freed Up experience is applicable to everyone, regardless of your life stage or financial status.

Course Overview

Each week you will have roughly one hour of course homework to complete before your weekly meeting. Then each week when you come together with your Freed Up group and group leader you will process through the previous week and prepare for the next. Each meeting will be 90 minutes.

SUMMER 2025: SESSION 1

Tuesdays at 7PM or Thursdays at 7PM

June 10 – July 24

SUMMER 2025: SESSION 2

Tuesdays at 7PM or Thursdays at 7PM

July 1 – August 15

COLLEGE STUDENTS

Sundays, Mondays, or Thursdays

June 15 – July 27

FALL 2025

September – October

Cost of course materials: $22 per individual or couple

How it Works

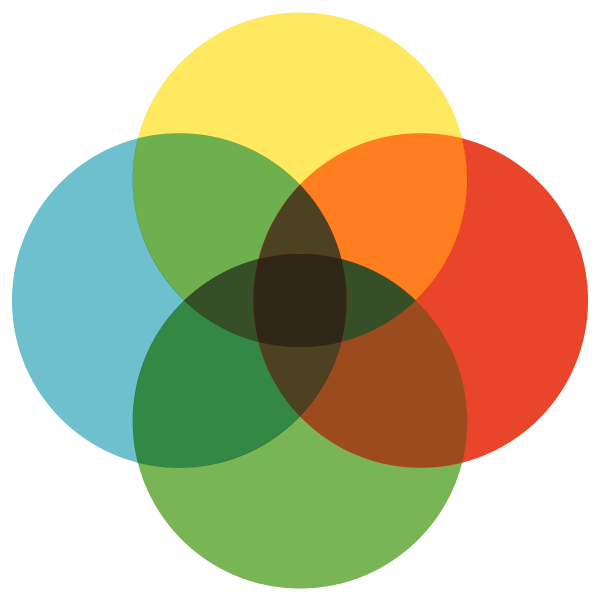

Choose Your Lane

Everyone’s financial situation is different. That’s why FreedUp was designed with a 3 Lanes approach. Choose what you need most right now:

- to gain Stability in your finances

- to find Clarity around where your money is going,

- or help building a Legacy.

You take an assessment that suggests the right lane for you, but you ultimately get to choose. This lane is not public to your course mates.

Create Your Spending Plan

During the FreedUp program, you’ll create a Spending Plan. Your Spending Plan is a great tool for intentionally directing and balancing your resources among the Lifestyle, Giving, and Saving categories.

Achieve Your Financial Goals

Intentionally spending your resources month-to-month is only half of the journey. With FreedUp, you will stack your goals to keep up the healthy financial behaviors you learn throughout the experience.

Week 0 – Getting Started

During the first week you will get introduced to the Freed Up course materials, course flow and meet your group and group leader.

Week 1 – Freedom in Stewardship

The second week will focus on cash flow and net worth. You’ll complete some fun activities like The Money Motivations Quiz and a Stewardship Assessment.

Week 2 – Diligent Earner

During the third week, you’ll focus on income and housing expenses. You’ll also develop your Diligent Earner Action Plan.

Week 3 – Prudent Spender

Your fourth week of FreedUp will focus on your lifestyle habits. After that, you’ll get to make a spending plan according to those habits.

Week 4 – Generous Giver

At week five, you’ve passed your half way mark. This is the week that’s focused on giving.

Week 5 – Wise Saver

Week six is about finding ways to save money in your budget. You’ll create a wise saver action plan.

Week 6 – Cautious Debtor

To wrap up the FreedUp experience, week seven is about debt and how it can have a snowball effect on your finances if you aren’t careful.